child tax credit 2021 income limit

Well tell you when this payment will arrive and how to unenroll. Threshold for those entitled to Child Tax Credit only.

What Are Marriage Penalties And Bonuses Tax Policy Center

They earn 150000 or less per year for a married couple.

. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. As long as your adjusted gross income or AGI is 75000 or less single-taxpayer households will qualify for the full child tax credit amount. The credit amounts will increase for many.

The income limit is 75000 if youre filing single and under 150000 if youre. The Child Tax Credit begins to be reduced to 2000 per child when the taxpayers modified adjusted gross income in 2021 exceeds. 150000 if married and filing a joint return.

For the first phaseout in 2021 the child tax credit begins to be. 150000 if married and filing a joint return or if filing as a qualifying widow or widower. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 75000 if you are a single filer or are married and filing a separate return. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

We expected our CTC to be 6000 with the new rule minus the. If you earn more than this. Above 75000 the amount begins.

Families making 150000 a year or less will get the full credit. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. Withdrawal threshold rate 41.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. Ad The new advance Child Tax Credit is based on your previously filed tax return. According to the IRS website working families will be eligible for the whole child tax credit if.

Our AGI is 192000. 2021 to 2022 2020 to 2021. This is up from the 2020 child tax credit.

3600 for each qualifying child who has not reached age 6 by the Insurance News. 3600 for children ages 5 and under at the end of 2021. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. We received 2100 in advanced Child Tax Credit CTC in 2021. 112500 if filing as head of household.

The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for children under the age of 6. The overall credit is reduced by 50 for every 1000 over the phaseout or limit until its eliminated entirely. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying.

They earn 112500 or. Previously you were not able to get this credit for your child if they were 17. The child tax credit was expanded to up to 3600 for the 2021 tax year.

150000 for a person who. For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. And 3000 for children ages.

This is up from 16480 in 2021-22. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of. Our kids are 15 and 13.

Only one child tax credit payment is left this year. Heres what you need to know about the credit and how it will affect your taxes. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

For the tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. The advance is 50 of your child tax credit with the rest claimed on next years return. Only for tax years beginning in 2021 Section 9611 of the American Rescue Plan Act increases the refundable portion of the child tax credit to 3000 for qualifying children.

In previous years 17-year-olds werent. Half of the total amount came as six monthly.

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Definition Taxedu Tax Foundation

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Child Tax Credit 2021 8 Things You Need To Know District Capital

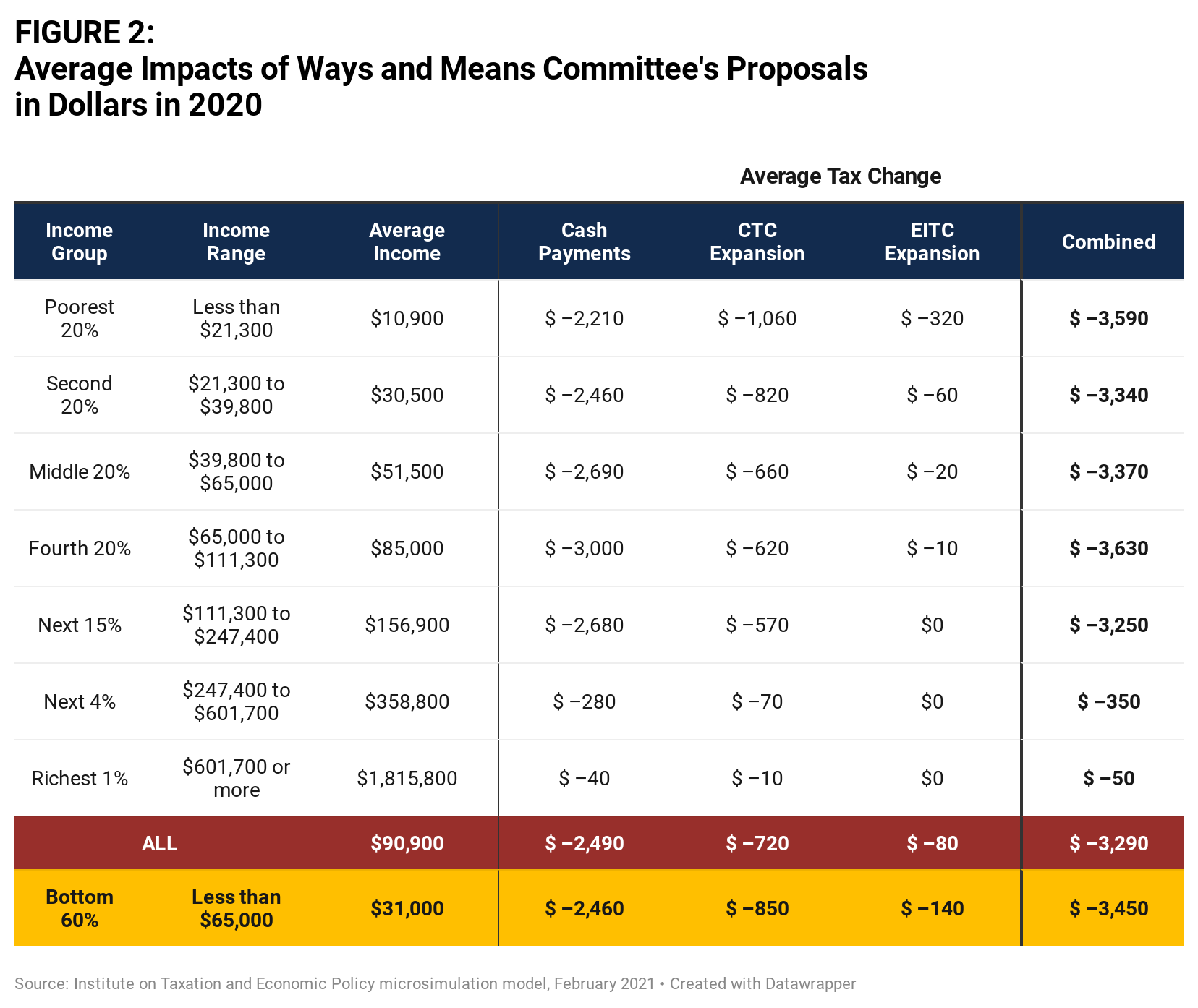

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

What S The Most I Would Have To Repay The Irs Kff

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

Parents Guide To The Child Tax Credit Nextadvisor With Time

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

Child Tax Credit Definition Taxedu Tax Foundation

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Here S Who Qualifies For The New 3 000 Child Tax Credit

2021 Child Tax Credit Advanced Payment Option Tas

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits