maine excise tax rate

Property Tax Stabilization Program. Other items including gasoline alcohol and cigarettes are subject to various Kentucky excise taxes in addition to the sales tax.

Historical Maine Tax Policy Information Ballotpedia

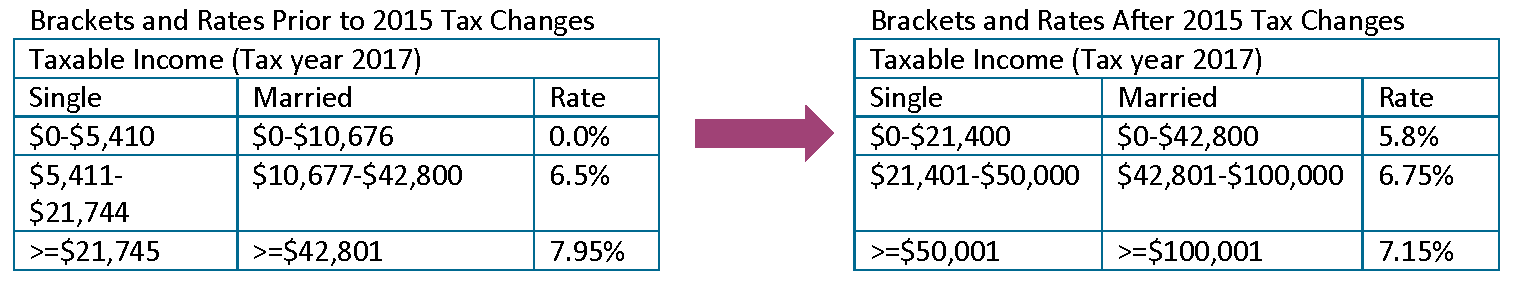

State Tax Changes Effective January.

. SalesUse. You can print a 881 sales tax table here. The Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax.

Groceries are exempt from the Louisiana sales tax. For tax rates in other cities see Colorado sales taxes by city and county. 120 Day Notice - 10 Year Compliance Letter PDF.

YEAR 3 0135 mill rate. Additional levies on fuel are collected for the Ground and Surface Waters Clean-up and Response Fund. The state excise tax on gas in Maine is 30 cents per gallon of regular gasoline.

For example California levies a 965 per ounce tax on marijuana flowers a 287 per ounce tax on marijuana leaves and a 135 per ounce tax on fresh plant material. Information Needed on Property Tax Bills PDF 2022 Tree Growth Rates PDF 2021 Property Tax Legislative Changes PDF 2022 Municipal Valuation Return MVR MS Excel 2022 MVR Instructions PDF 2022 Sample Tax Rate Calculation Form MS Excel Sample Tree Growth Tax Law Program Notices. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Washington has a 65 sales tax and King County collects an additional NA so the minimum sales tax rate in King County is 65 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in King County. Clothing has a higher tax rate when you spend over 175and a special local sales tax of 075 may apply to meals purchased in some localities. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Counties and cities can charge an additional local sales tax of up to 7 for a maximum possible combined sales tax of 11. YEAR 1 0240 mill rate. North Carolinas 25 percent corporate tax rate is the lowest in the country followed by Missouri 4 percent and North Dakota 431 percent.

Not every state with a significant amount of nonresident income uses it to lighten the tax load of its own residents. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of. A special sales tax on alcoholic beverages was repealed in 2010.

The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 93 from 1993 until 2022On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US volume-weighted. Wednesday November 9 Augusta. Property Tax Law Changes 2022.

Douglas County collects the highest property tax in Colorado levying an average of 076 of median home value yearly in property taxes while Costilla County. The US corporate tax rate was 35 prior to the passage of the Tax Cuts and Jobs Act ten percentage points higher than the OECD average of 25. YEAR 2 0175 mill rate.

Excise taxes on alcoholic beverages amusements insurance premiums motor fuels pari-mutuels public utilities tobacco products and other miscellaneous transactions. Business purchases for resale are also exempt with the use of a Sales Tax Resale Certificate Form ST-4 completed by the buyer. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

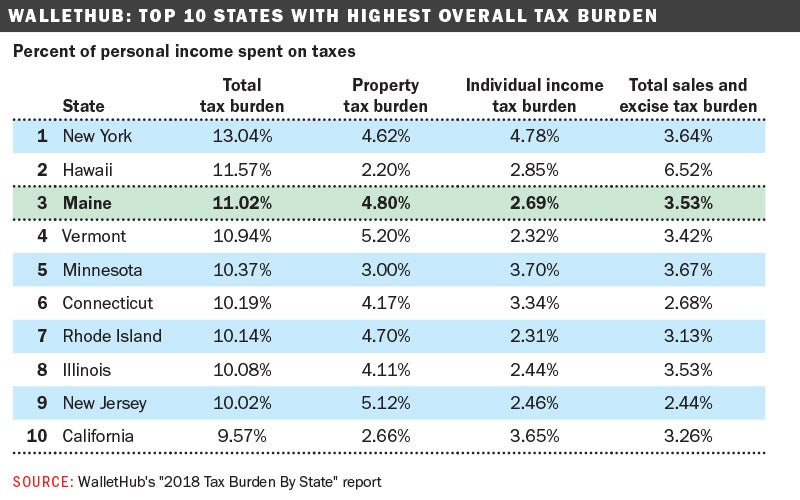

State-Local Effective Tax Rate Rank. March 2023 Certified Maine Assessor CMA Exams. Maines maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Property Tax Educational Programs. Susan Collins of Maine and Steve Daines of Montana ultimately voted for the Senate bill. This means that the applicable sales tax rate is.

Withholding and Unemployment Contributions 941ME and ME UC-1 Withholding Tables and Annual Reconciliation W-3ME. Counties and cities can charge an additional local sales tax of up to 15 for a maximum possible combined sales tax of 75. Louisiana has 667 special sales tax jurisdictions with local sales taxes in addition to the state.

This means that the applicable sales tax rate is the same no matter where you are in Maine. Colorado is ranked 36th of the 50 states for property taxes as a percentage of median income. Florida 4458 percent Colorado 455 percent Arizona 49 percent Utah 495 percent and Kentucky Mississippi and South Carolina 5 percent.

The rates drop back on January 1st of each year. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. There is no applicable county tax.

In 2006 only six states had an excise tax rate of at least 2000. Groceries and prescription drugs are exempt from the Florida sales tax. States with this type of tax also typically set different rates for different marijuana products.

Seven other states impose top rates at or below 5 percent. The 881 sales tax rate in Denver consists of 29 Colorado state sales tax 48099 Denver tax and 11 Special tax. In Maine the median property tax rate is 1320 per 100000 of assessed home value.

The United States of America has separate federal state and local governments with taxes imposed at each of these levels. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735.

That means any taxable estate with a value over 1187 million will face the top marginal rate. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Four Issues with Proposal to Increase Tobacco and Vapor Taxes in Maine.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Maine Estate and Inheritance Taxes. Meanwhile total taxes on diesel are 312 cents per.

Florida has 993 special sales tax jurisdictions with local sales taxes in addition to the. In some states items like alcohol and prepared food including restaurant meals and some. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Twelve states Alaska Arizona California Delaware Illinois Maine Michigan New Jersey New Mexico Oklahoma Pennsylvania and Wisconsin have a cigarette excise tax from 2000 to 2999 per pack. Groceries are exempt from the New Mexico sales tax. Excise taxes are commonly levied on items like cigarettes alcoholic beverages and gasoline.

As with other wholesale taxes it is assumed most of this cost is passed on to. An excise tax is a tax imposed on a specific good or activity. Counties and cities can charge an additional local sales tax of up to 3563 for a maximum possible combined sales tax of 8693.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. The excise tax applies to any organization that is tax-exempt under 501c or 501d a Section 521b1. The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel.

Groceries and prescription drugs are exempt from the Colorado sales tax. The exact property tax levied depends on the county in Colorado the property is located in. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes.

Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. New Mexico has 419 special sales tax jurisdictions with local sales taxes in addition to the. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

Tax Relief Programs Exemptions.

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

How Maine S Personal Income Taxes Work Mecep

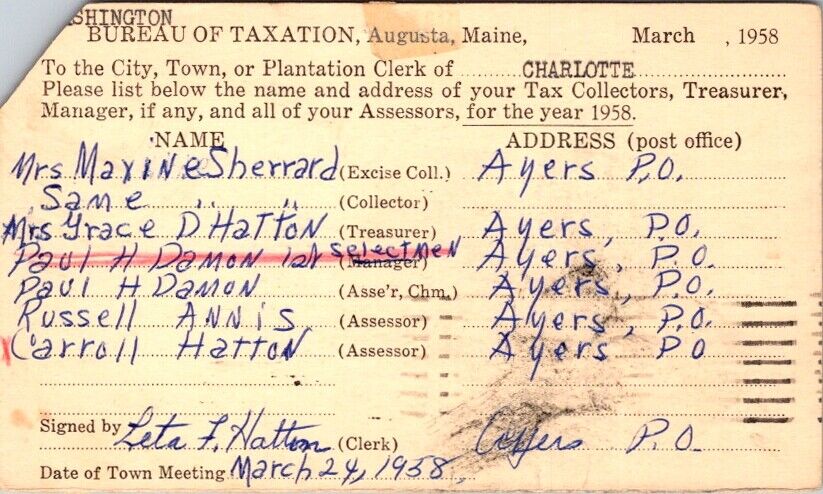

Postal Card State Of Maine Bureau Of Taxation To Charlotte Maine Me 1958 S348 Ebay

Maine Who Pays 6th Edition Itep

It Is A Pickup Truck At Least In Maine It Is Hyundai Santa Cruz Forum

Maine Car Registration A Helpful Illustrative Guide

Welcome To The City Of Bangor Maine Excise Tax Calculator

Motor Vehicle Registration Scarborough Town Of

Helpful Me Fuel Tax Links Mflc

Cannabis License Consultant In Maine Marijuana Application Writers

Sales Tax Laws By State Ultimate Guide For Business Owners

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Maine Sales Tax Small Business Guide Truic

A Glass Half Full Is Current State Of Maine Brewing Industry Penbay Pilot

Property Tax Stabilization Program For Seniors Cumberland Me

Want To Lower Maine S Tax Burden Don T Forget To Consider Raising Incomes

Car Tax By State Usa Manual Car Sales Tax Calculator

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation